So if we look at AMZN here with nothing but the 21 EMA, it made a powerful move off of the 21 EMA and then abruptly pulled back to it. Hypothetically speaking, if the stock goes up or down, ALL stocks do is move away from the 21 EMA, and back to it. The premise of RTM advocates that price and historical returns will return to the mean of the entire data points of the stock.

If you can understand this, you can be in rhythm with the market. The concept of reversion to the mean (RTM) is one of the most important concepts to understand as a trader. Here are my settings for the 21 EMA on my charts:

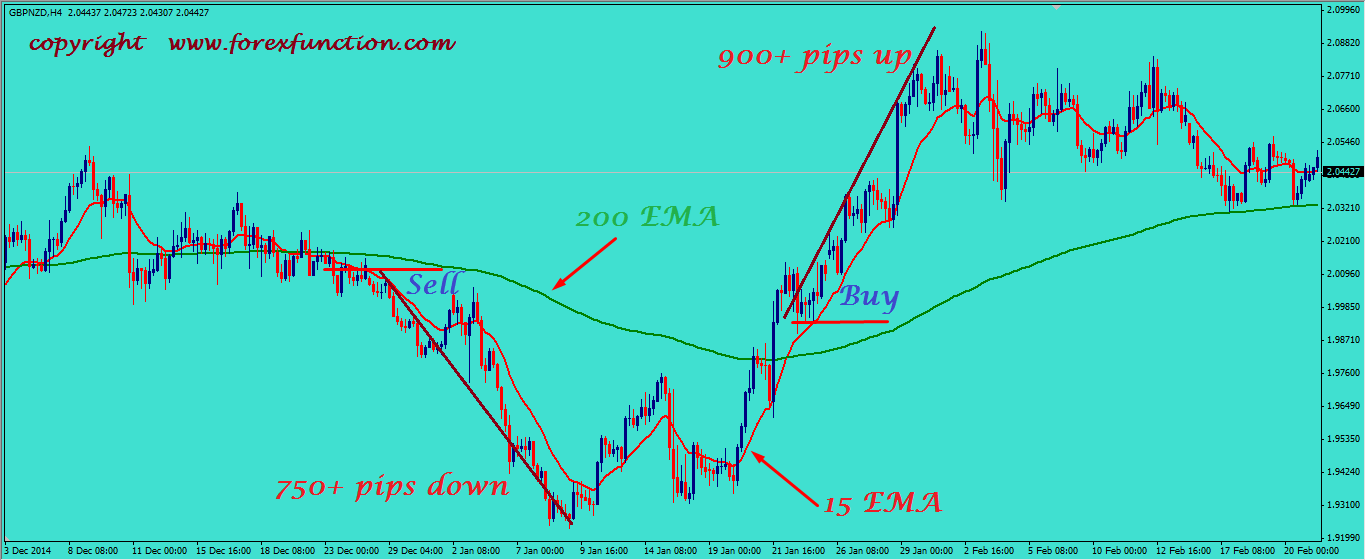

What you should know as a trader is that most big moves tend to start at the 21 EMA, so we can use this level as a starting point for our trades – because stocks always come back to the mean. Think about the 21-day EMA (or 21 EMA) as the “the mean.” All stocks do is move away from, or back to, the 21 EMA. If the EMA indicator rises or falls it will essentially help the trader make a decision on entry and exit points for a trade. The EMA helps identify trends for traders. So a shorter period of EMA will have a greater weight on recent price than a longer period. In addition, if the time frame is longer, the weighting is less pronounced. On the other hand, the 200-day EMA would likely be for long-term investors. Shorter time periods, like the 8-day EMA, are for trading over shorter time frames. Given the emphasis on recent prices, a day trader may be more interested in looking at the EMA indicator because the calculation will be more time sensitive.Īlso, we use different EMAs over different time periods. The choice of whether to use an SMA or EMA will really depend on the time period you’re looking at and the type of trader you are. A lot of times you’ll see charts with both SMA and EMA lines because each is giving the trader a different take on the situation. So should you use SMAs or EMAs on your chart? It’s really a personal choice. The EMA is different in that it places more importance on the latest price data by assigning a greater weight to the more recent prices in the calculation. The SMA, or simple moving average, is basically the moving average calculation you learned in statistics class: it’s the sum of the average prices over the number of periods. In the chat rooms, we talk a lot about EMAs and SMAs on our charts.

#EMA TO STOCK FREE#

Moving average is the foundational statistical calculation for many of the most popular free and paid indicators in trading. Let’s talk about what an EMA is and how you can use this indicator in your trading. EMAs are undeniably in the latter category. Some tools don’t make the cut, while others have become vital to my setups.

In my 10+ years of trading, I have come across a multitude of tools as I strive to improve my trading every day and refine my strategy. Past performance is a poor indicator of future performance.Every trade setup I make starts with checking out exponential moving average (EMA) lines on my charts. In no event shall Alpha Spread Limited be liable to any member, guest or third party for any damages of any kind arising out of the use of any content or other material published or available on or relating to the use of, or inability to use, or any content, including, without limitation, any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages.

The information on this site is in no way guaranteed for completeness, accuracy or in any other way. The information on this site, and in its related newsletters, is not intended to be, nor does it constitute, investment advice or recommendations. Under no circumstances does any information posted on represent a recommendation to buy or sell a security. Is not operated by a broker, a dealer, or a registered investment adviser.

0 kommentar(er)

0 kommentar(er)